Token

Current supply

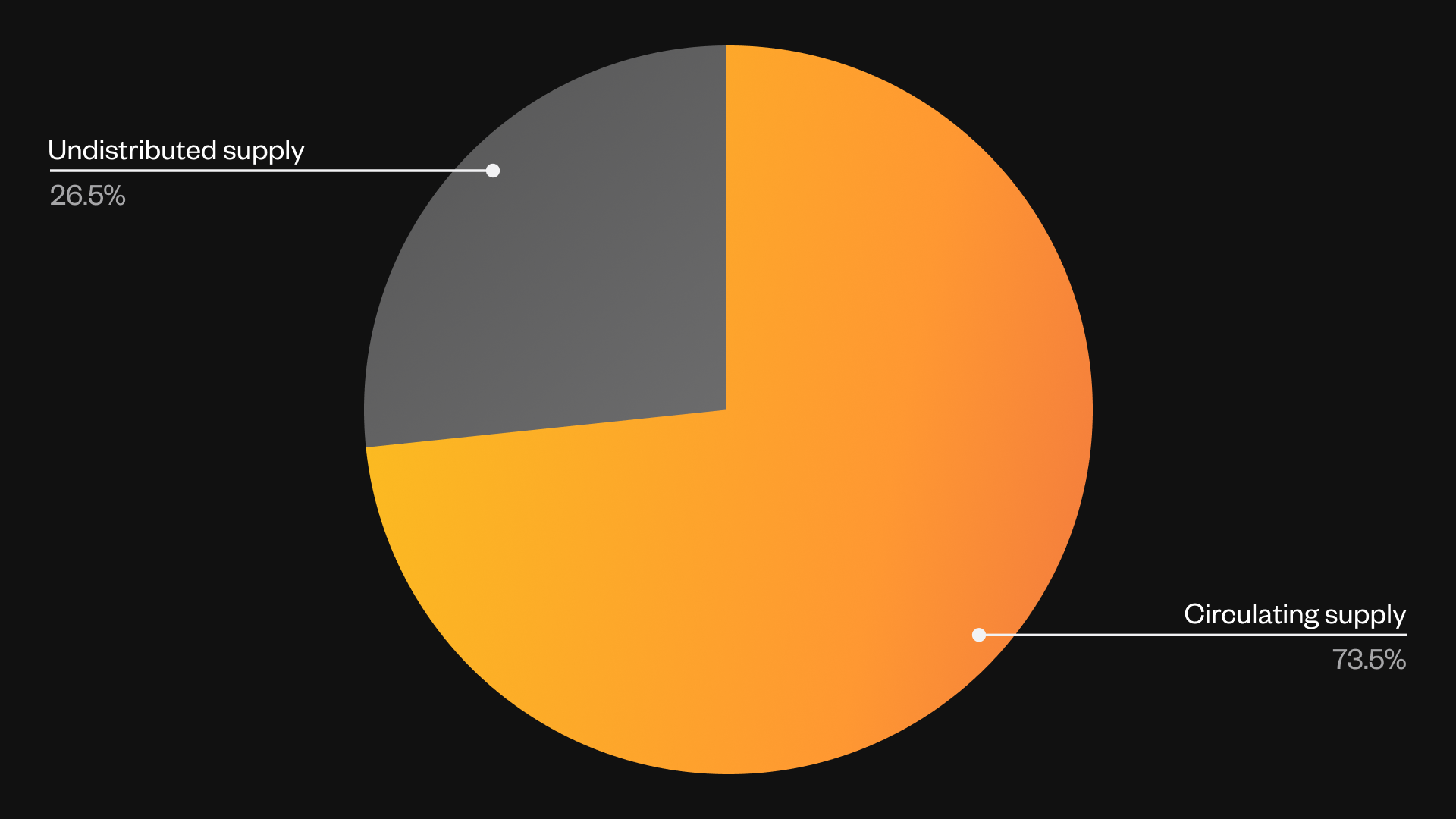

NOIA token, which is an ERC-20 token, will have around 73.5% of its supply circulating at the end of 2023. This leaves 26.5% of undistributed supply, which will be used for various incentives in Synternet Chain and Data Layer as well as future financing.

Figure: Current token supply

Figure: Current token supply

Incentives for chain security

Synternet will have a dedicated pool of tokens – reward pool – with a release algorithm to support the Validator network in the form of block formation rewards. The targeted stake rate (aka bonding rate) will be between 50%-67% as compared to circulating supply. In Synternet’s case it is possible to target a stake rate lower than 67%, since some significant amount of tokens are bonded on the Data Layer.

The annual reward rate change is set by the following:

RewardChgPerYear = (1 - BondingRate / BondingGoal ) * (RewardMax - RewardMin)

where:

BondingRate = TotalTokensBonded / CirculatingSupply

The reward rate will be slowly increasing towards the maximum possible rate (RewardMax) when stake to circulating supply ratio (BondingRate) is below the target (BondingGoal). Conversely, reward rate will be slowly decreasing towards the minimum possible rate (RewardMin) when stakes are exceeding the target. However, the total amount of rewards over time since genesis cannot exceed the value reserved in the dedicated reward pool.

In practice, this calculation will be performed at every block. The annual reward rate change is then divided by the total number of blocks per year to obtain the reward rate change introduced by each block.

In mainnet, these rewards will be enough to guarantee block formation rewards to Validators and Delegators. The APRs (including the gas fees) for Validator network are expected to be between 12-20% in the formative years and 5-12% in the long run. With time the rewards will increasingly depend on the amount of gas fees collected, which in turn depends on the amount of data being piped through the Data Layer.

The actual levels of minimum, maximum, and starting level of reward rate as well as size of the reward pool will be announced before entering the mainnet. The testnet phase will greatly affect the starting values of these parameters, as it will be much easier to estimate the expected demand and the expected amount of gas fees collected.

Incentives for Data Layer

In order to attract actors into the system, there exists a subsidy program for Brokers and Observers, similar to the block formation rewards. Both of these actors are required to credit a required amount of tokens on-chain when registering for their roles. The subsidy rate change is calculated the same way as reward rate change in the chain security layer:

SubsidyChgPerYear = (1 - CreditingRate / CreditingGoal ) * (SubsidyMax - SubsidyMin)

However, note that the credit requirement is fixed and there’s no delegation. So, for example, the crediting rate goal for Brokers essentially regulates the number of Broker entities within the system, because:

CreditingRate_Brokers = (Number_Brokers * CreditRequirement_Broker) / CirculatingSupply

In this way, the number of these actors within the system can be influenced through targeting a respective Broker or Observer crediting rate. If these rates do not yet reach the desired level, the subsidy rates are growing. Vice versa, if the credits locked on-chain overshoot the target level, subsidy rates will be decreasing and in turn making the APRs smaller.

The credits locked by Brokers and Consumers are significantly smaller than tokens delegated to the chain security. This also means that the amount of incentivization needed to sustain these subsidies and attract professional actors is only a couple percent. The limited token supply model also requires that the pool for subsidies is reserved upfront and only for a limited time. In the long term, the only source of Broker and Observer income comes from the network fee.

The exact numbers of how much each Broker and Observer is required to stake, their target crediting rates, minimum and maximum subsidy rates, as well as the subsidy pool size will be announced before the mainnet. The testnet phase will greatly affect the starting values of these parameters, as it will be much easier to estimate the expected demand and the expected amount of network fee collected.

The majority of these parameters are stored on-chain and can be changed via proposals. This ensures that if some parameter has to be changed with time due to the fundamental changes in the economy, it can be done.

Brokers and Observers can expect APRs of 20-30%. These come with a premium as compared to Validator rewards, since these actors are highly specialized, unique to Synternet Data Layer, and may need more involvement from their operators from the get go.

Community pool

A portion of the total Synternet token supply will be dedicated to the community pool. How these funds are present will be decided through Synternet chain governance. There is a single limitation though, the expenditure will have to be spread over the first 4-6 years, so the total amount of tokens that can be spent from the community pool per each year will be constrained.

The expected use of these tokens is the support of the Publisher infrastructure. By smartly distributing these tokens, the Synternet community can ensure that at least some essential Web3 data is virtually free for the users. Initially, cheap data should attract more users to the Data Layer protocol.

For example, a Publisher who was publishing useful data for a low fee and had multiple subscriptions has a very good chance to get a subsidy from Community pool. The proposal has to be put on-chain and Validators are very likely to approve it, since this data stream was generating gas fees for them and will be generating more if Publisher has financial means to continue operating.