Data Layer

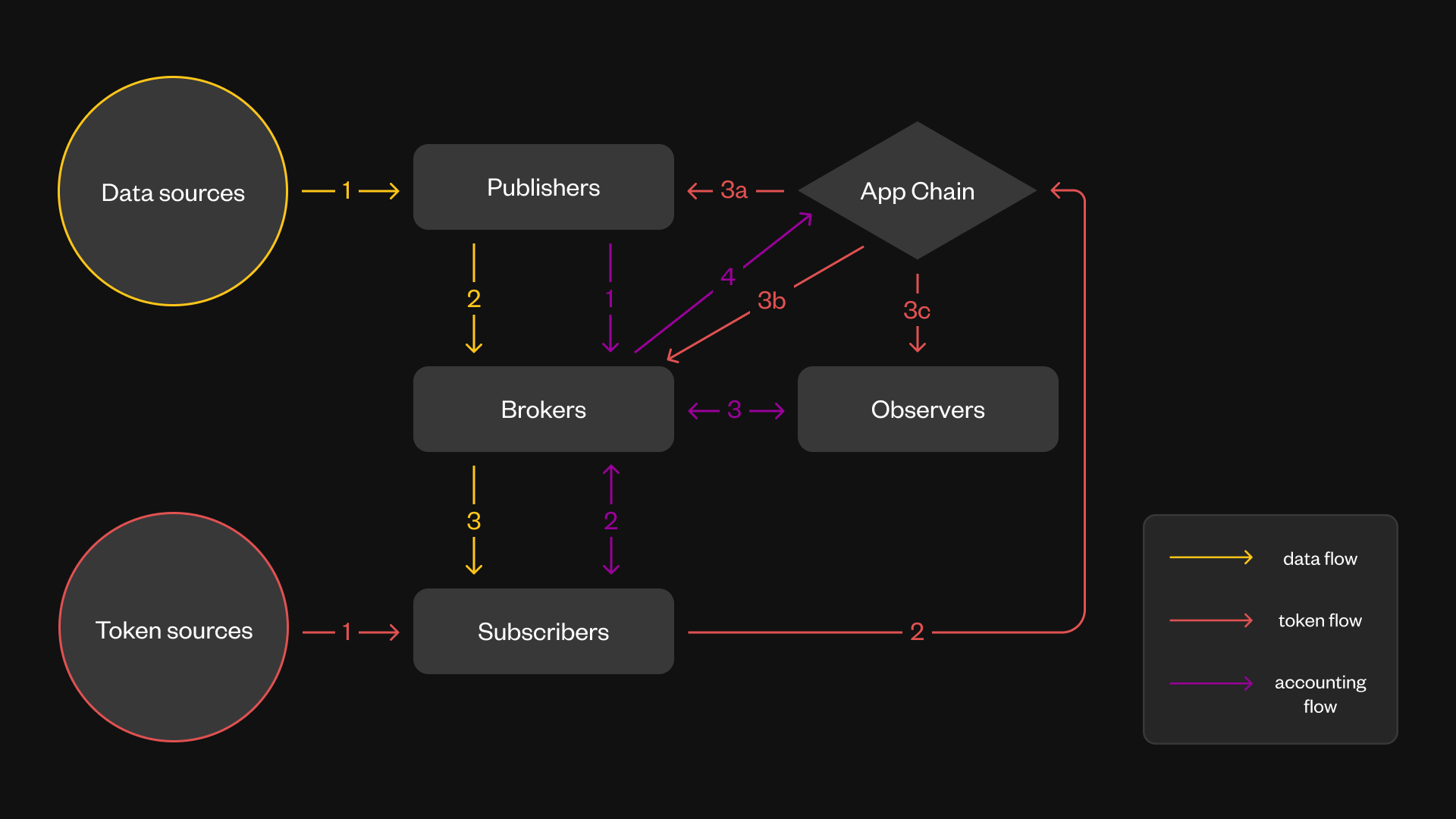

Economic actors

- Publishers produce data and receive payment based on the interest in the data they provide.

- Subscribers buy data from Publishers and receive it by connecting to the Brokers.

- Brokers relay data from Publishers to Subscribers, receive rewards based on the amount of data they relayed to the Subscribers, and account for the data usage.

- Observers verify whether the accounting information provided by Brokers is correct.

Figure: Token flow and data flow

Figure: Token flow and data flow

Economic relations

Subscribers are the sole token contributors to the whole system since they represent the demand. They are paying directly and indirectly to other actors on both the Data Layer as well as the App Chain.

Since Publishers, Brokers, and Observers are providing their services on the Data Layer, we often refer to them together as the service providers.

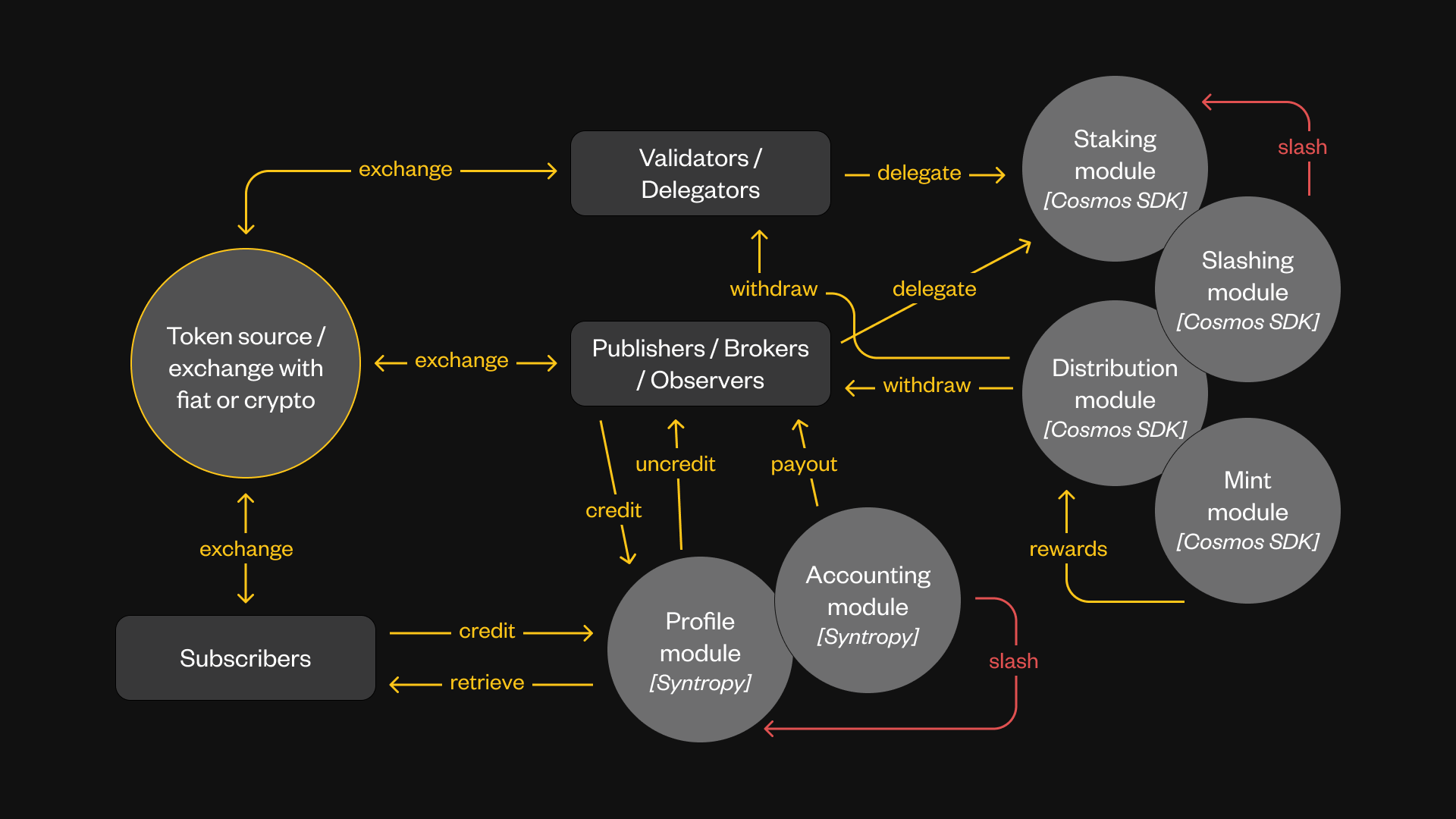

Crediting

The service providers on the Data Layer, such as Publishers, Brokers, and Observers, are required to credit or, essentially, lock some tokens to the services they provide. This mechanism is similar to that of staking or delegation for the Validators. This locking of tokens has several functions:

- They show the intent to deliver what’s being promised.

- They act as a security measure and can be slashed when actors are proven guilty of misconduct.

- In some cases, they can show the value of the service.

The tokens delegated to the chain security cannot be at the same time credited on the Data Layer.

The credit sizes are fixed parameters that can be changed through on-chain governance.

Rewards

In the long term, the sole source of income for service providers is the payments for data from Subscribers. In the early stages, crediting profile for providing a service on the chain earns subsidies for Brokers and Observers. Whereas, Publishers are encouraged to ask subsidies from the community pool.

Earned tokens can be reinvested back into the system:

- Publishers can create more subjects and push more data only by crediting more.

- Brokers have to maintain the continuous crediting requirement.

- All actors can delegate their tokens to Validators increasing their returns as well as engaging in governance.

Some of these credit-based requirements might only be present in the improved version of tokenomics and are not included in v1

Alternatively, tokens can be exchanged into fiat currency to cover nodes’ operating costs.

Figure: All the token flows

Figure: All the token flows

Credit slashing

Tokens locked by the service providers are managed via on-chain logic. Therefore, if valid cryptographic proof of misconduct is submitted on-chain, the penalties will be imposed by slashing the credits of the actors that were proven to have acted maliciously.

For example, it takes a single honest Observer to provide such proof, and then the Broker who cheated and all the dishonest Observers who were in collusion with this Broker and approved that malicious behavior, are also penalized.

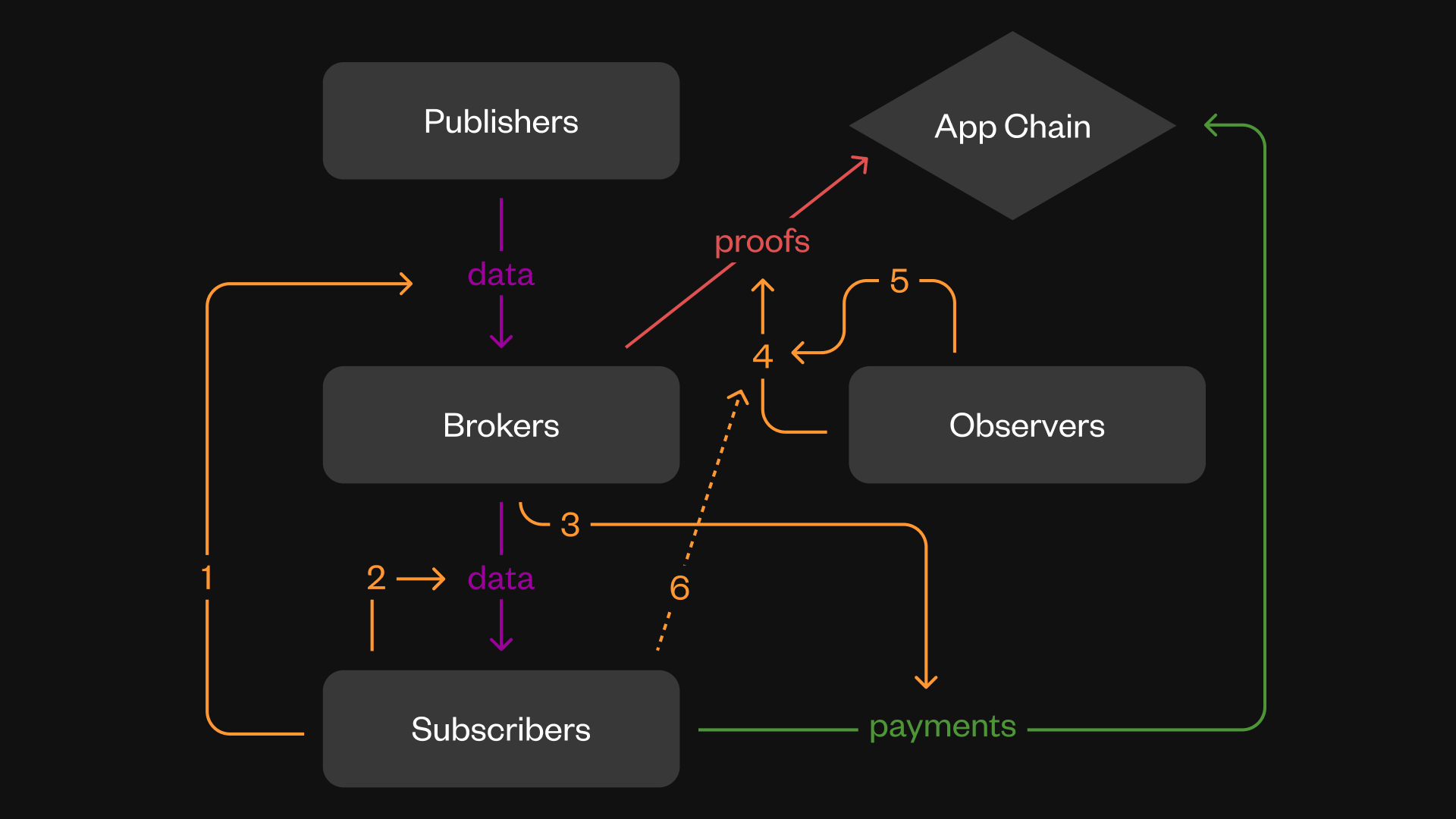

Control relations

Within a decentralized protocol, there’s no single authority, which can keep every actor in check. Thus, the following control relations are defined in the Synternet tokenomics v1:

- The work of Publishers is monitored by Subscribers. If the Subscriber is not satisfied with the performance of the Publisher, it can stop using the service.

- The work of Brokers is monitored by Subscribers. If the Subscriber is not satisfied with the performance of the Broker, he can stop using the service. Additionally, if the Subscriber detects a provable payment misconduct then the Subscriber may enforce a penalization on the Broker.

- The payments of Subscribers are monitored by Brokers. If the payment is not made then the service is stopped.

- The work and payment requests of Brokers are monitored by Observers. Any provable misconduct of Brokers detected by Observers is penalized.

- The work of Observers is monitored by Observers themselves. Any provable misconduct of Observers detected by Observers is penalized.

- The work of Observers can indirectly be monitored by a Subscriber, where the Subscriber detects payment misconduct made by the Broker and not detected by the Observer (considered as a feature in the future tokenomics versions).

Figure: Control relations

Figure: Control relations